does california have an estate tax return

In California retirement accounts and pension plans are taxed income taxes can be as high as 123 and people that earn more than 1 million are also subject to a 1 surtax. Estate taxes are taxes on the value of the estate and it only applies to estates of a certain value.

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries.

. Complete the IT-2 if a decedent had property located in California and was not a California resident. Does California Have an Inheritance Tax or Estate Tax. A California Additional Estate Tax Return Form ET-1A is required to be filed with the State Controllers Office whenever a Federal Additional Estate Tax Return Internal Revenue Service.

For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return. Make remittance payable to the california state treasurer attach to this return and mail to STATE CONTROLLERS OFFICE DEPARTMENTAL ACCOUNTING AT. A return or extension may be.

California sales tax rates range from 735 to 1025. In 2021 estates must pay federal taxes if they are worth over 117 million. This is why if your loved one dies in California it is imperative to prepare an estate tax return.

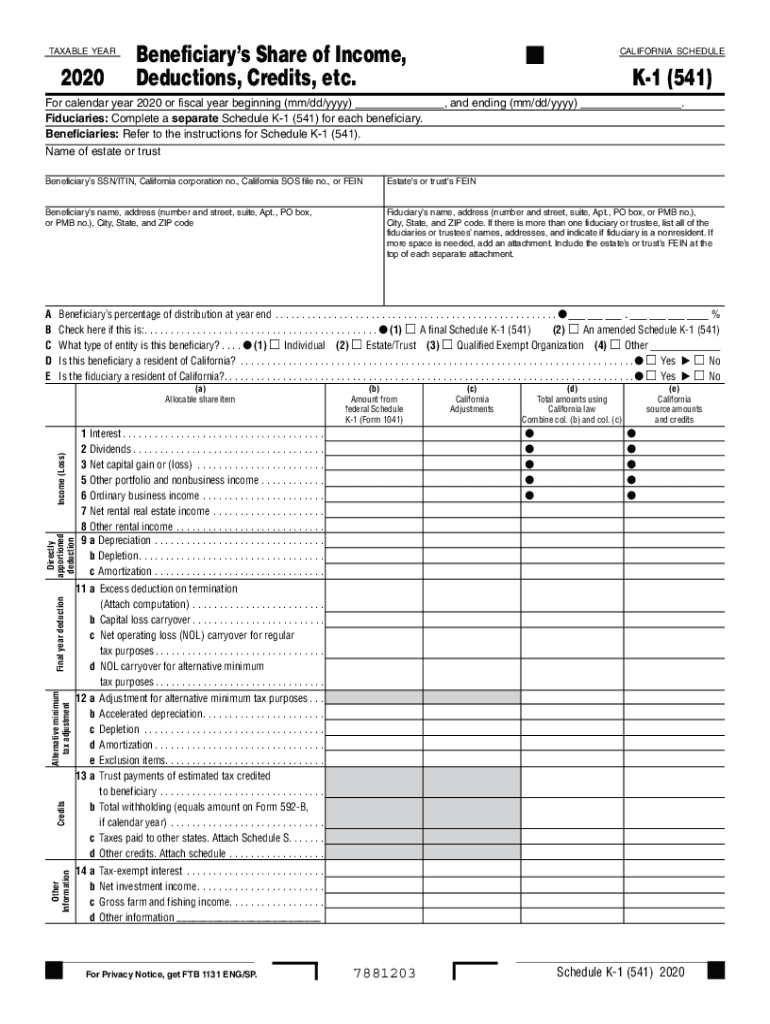

Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. The state of California does not impose an inheritance tax. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal.

In 2021 only estates with combined gross assets. For decedents that die on or after June 8 1982 and before. The tax return and payment are due nine months after the estate owners date of.

The states government abolished the. California does not have an estate tax. Washington estate tax forms and estate tax payment.

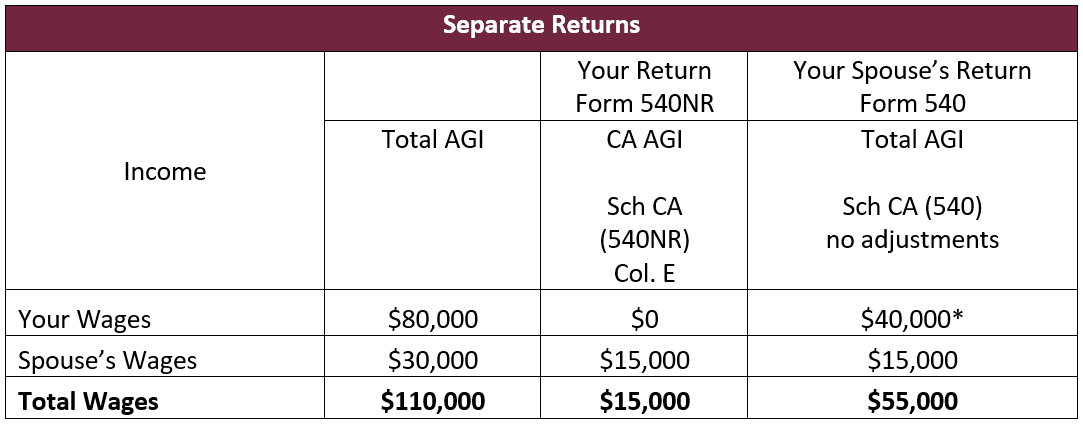

The states estate-tax will be paid by the surviving beneficiaries. A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of. In fact few states do as of 2021 only 12 states and the District of Columbia impose an estate tax.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. California is quite fair when it comes to property taxes when you look. This base rate is the highest of any state.

If your estate doesnt exceed. The types of taxes a deceased taxpayers estate. However California residents are subject to federal laws governing gifts during their lives and their estates after they die.

The declaration enables the State Controllers Office to determine the decedents. California residents are not required to file for state inheritance taxes. California does not have an inheritance tax estate tax or gift tax.

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. A request for an extension to file the Washington estate tax return and an estimated payment.

Estate Tax Information Noevalleylaw

California Estate Tax Is Inheritance Taxable Income

Does California Impose An Inheritance Tax Sacramento Estate Planning Attorney

California Estate Tax Everything You Need To Know Smartasset

The California Safe Harbor For Residents Working Abroad Krost

Attorney At Law Do I Need To File An Estate Tax Return Tbr News Media

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

California Income Tax Returns Can Be E Filed Now Start Free

Fillable Online Ftb Ca California Franchise Tax Board Form 3571 Fax Email Print Pdffiller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Tax And Estate Planning Sacramento Business Attorneys Real Estate Lawyers Healthcare Attorney Labor Law Murphy Austin Adams Schoenfeld Llp Sacramento California Law Firm

California Estate Tax Magnifymoney

2018 Form K 1 Fill Out Sign Online Dochub

People Like The Estate Tax A Whole Lot More When They Learn How Wealth Is Distributed Los Angeles Times

Federal Gift Tax Vs California Inheritance Tax

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Understanding The Estate Tax Return Marotta On Money

Irs Form 540 California Resident Income Tax Return

Is There A California Estate Tax In California Pasadena Estate Planning